The startup landscape is experiencing a prolonged spell of funding winter. The year 2023 concluded with a dull note for global funding, capping the lowest venture funding since 2018. The global funding data was recorded at USD 285 billion in 2023, compared to USD 462 billion and a significant decrease of 38% compared to the previous year. This decrease in VC spending is across stages of start-up funding. In the seed stage, pre-revenue start-ups were reduced by 30%, followed by late-stage and early-stage funding, which went down by 37% and 40%, respectively.

This doesn’t mean that it is all downhill from here. The start-up ecosystem is better than during the pandemic, but not completely out of the woods. The 2023 funding was down by 20% compared to 2018-2020, which shows that investors are putting their trust and money into the growth of the start-up ecosystem steadily and slowly.

A funding database reveals funding trends across verticals and is a powerful tool for growth and collaboration. It helps financiers and entrepreneurs navigate the complex investment ecosystem, opening doors to new opportunities. For start-ups and businesses, it’s a gateway to meeting investors and VCs to raise funds. For other companies, it’s an indispensable resource for fostering collaboration and networking, paving the way for mutual growth.

Before we delve into the ‘hows’ of company funding data, let’s explore the ‘whys.’

The Worldwide Fundings Data Trends

The adverse funding climate led to the shutdown of 770 start-ups in 2023. This number is unverifiable as many closures go unnoticed and unreported. The fortunate one who made it through the year was AI, among many others. In 2023, AI ruled the charts, and AI start-ups received around USD 50 billion in funding. The foundation model AI companies Antropic, Inflection AI, and Open AI received most of it and were the major beneficiaries, raising USD 18 billion. The global funding data also revealed a positive trend for semiconductors and battery tech. Manufacturing and cleantech businesses also performed better; however, they experienced a decline in funding coming their way compared to the previous year.

While some sectors thrived, others faced significant challenges. The e-commerce and shopping, financial services, and media and entertainment sectors experienced a downward trend in funding. The Web3 ecosystem, which had shown promise, also saw a reduction in funding, dropping to USD 7.6 billion from USD 28 billion in the previous year.

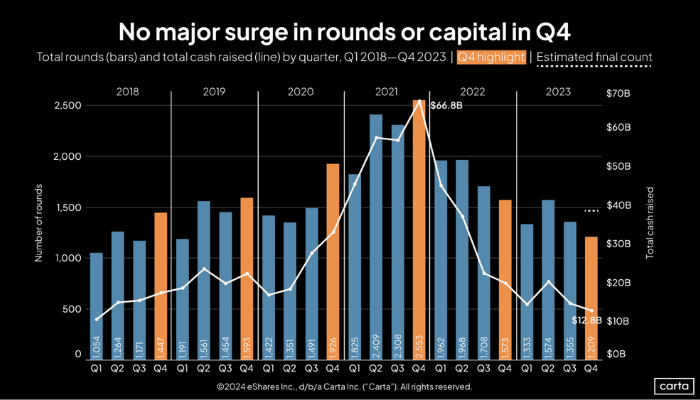

Image Courtesy: Carta

According to the numbers reported to Carta, the Q4 of 2023 was the slowest of the year, with only 1,209 venture deals coming to fruition. The equity management platform’s global funding data reveals a slump in seed activity (down 27%) investments. Investors declined to show money for early-stage businesses in most cases. In contrast, investors trusted late-stage valuations (increased by 71% at Series D and 46% at Series E+), hoping to get their money back with interest.

Amidst the cash flow crunch and investors’ reluctance to show money, bridge rounds turned out to be a blessing for new and struggling businesses to raise capital between major funding rounds from existing backers. In 2023, bridge rounds ruled the roost and gave businesses a much-needed breather and fuel to get going, especially in Series A (45% in Q4). Bridge rounds also bring in much-needed perspective for founders to get back on track. They can reduce costs, plan a strategic overhaul, or take a step back to determine what went wrong and charge ahead.

Also read: How jobs feed data can unlock market trends?

Why do start-ups need funding?

Cash flow is an integral aspect of a start-up operation. Businesses, especially new and budding entrepreneurs, need cash to take their ideas from conception and build them from the ground up. Even big businesses struggle and lay off due to a cash crunch. For start-ups and new businesses, it hits them where it hurts the most. They can’t pay salaries, scale up, meet orders or demands, or even perform the day-to-day operations required to stay afloat. This formidable macroeconomic ecosystem forces them to turn to venture debt.

Businesses can borrow money by pledging their intangible assets, such as their revenue trend in the next financial year or ARR (Annualised Recurring Revenue). If a start-up opts for a venture debt, it must be profitable and return the amount with interest in the stipulated time. If it is a late-stage start-up, the debt amount is calibrated based on the equity raised by the business. Venture debt is said to be efficient and productive at the early stage of a start-up, considering the performance objectives are met with lots of passion.

Besides, it is smaller than the later-stage loans, making it safer and easier to acquire. While underwriting these loans, lenders are interested in growth plans and how their money can support a business in materialising them. However, the real issue arises when businesses are unable to meet these goals. Start-ups failing to repay the venture debt may negotiate for more time, lower interest rates, or seek more financial assistance. However, if all fails, they may have to declare bankruptcy, liquidate their assets, and close shop.

The repercussion of funding reluctance, however, runs deep. For a founder, it means the idea is unmarketable. Their passion for their start-up is seen as a fad, not something that can clock profits, generate revenue, or change the world! The trend of dwindling global funding data also suggests the lack of mentorship that makes up for the lack of experience in start-up founders and helps them navigate the tricky terrain of the start-up ecosystem. In a starved environment, they tend to miss out on these crucial aspects, making it difficult for them to survive.

Why makes funding a herculean task for businesses?

VCs aren’t ready to show their wallets yet, and start-ups are struggling to sustain amidst the cash crunch. This onus pretty much lies on global macroeconomic events. The Ukraine conflict and the Israel-Palestine conflict have adversely impacted investors’ confidence. Apart from that, the performance of tech companies has been abysmal and doesn’t evoke much confidence. Besides inflation and increased interest rates, massive layoffs by tech companies at the first chance of a cash crunch make for a glooming ecosystem. Companies have failed to pivot and understand the pulse of the market, raining on the exuberant mood of investors so far. Investors prefer businesses that show judicious cash management, are employee-friendly, and are not in the news for the wrong reasons. They are sticking to businesses steadily making profits and following proper CDD processes. It is finally a character over personality, substance over style fight.

Equity isn’t equitable

Good luck, female founders! The odds are not in your favour. Male tech founders raise more money even if it is a Femtech company. The gender bias in venture capitalism is pronounced and stark. Global funding data reveals that a woman owns one in three businesses, and till 2019, only 3% of the female-owned businesses were funded, which was a 4% drop from the previous year. This staggering slump continued and was further reduced to 2% in 2020 and remained unchanged in 2021. This disparity stems from socioeconomic factors and prevailing gender roles in society that deem women lesser than their male counterparts in everything, including entrepreneurial capabilities. There is over USD 1.7 trillion financing gender gap for women-owned SME businesses worldwide.

However, this gender bias pattern changes across the world. A report on women entrepreneurship and funding data states that women entrepreneurs are least likely to be discriminated against in high-income countries such as Germany and the U.S. This doesn’t mean that it is a bed of roses or a walk in the park (we know even that isn’t easy or simple for women) for them in said countries. Still, it is more of a grey area. Notwithstanding, having an open-minded culture and women at the helm of existing major operations does change the perspective of VCs.

This gender inequality persists on the other side of the table, which could be one reason that women are not heard or stay invisible during pitching. It turns out that 15% of decision-makers are women in the UK VC industry. Thus, it is not surprising that only 3.5% of the UK VC funding went to women, and men received 6.2 times more money in both loans and equity.

This is absolutely gender bias and not a knowledge gap, which is evident from the fact that businesses founded and owned by women generated 10% more in cumulative revenue in a 5-year period and generated 78 cents for a dollar for the return on investment, compared to just 31 cents by men.

This is when the fundings data becomes more pertinent. A business trying to understand the market ecosystem or generate opportunities with recently funded companies needs to lead you to the right market.

Why is fundings data important?

As a business owner, it is imperative to understand the nitty-gritty of funding rounds, series, expectations, and biases at play. Information is power, which can make or break the deal. While a funding database can increase an entrepreneur’s chances exponentially of getting heard at the pitch table and receiving money, it helps other businesses screen potential business opportunities. Businesses can better identify recently funded companies with company funding information. Based on the funding rounds, they can find out when to approach the funded companies and how much of the budget is allocated for growth.

Depending upon its cash flow requirements, a business can generate funds in various rounds such as Series A, B, C, and so on. Since valuation is done at each funding round, it is an important benchmark to understand a business’s profitability and standing in the market. Valuation indicates its market size, revenue, expansion plan, aspirations, growth plan, and management. This information helps investors decide whether associating with a business will be beneficial or if it can generate profits and get their money back.

The company funding data is an indicator of the economy and pulse of the market. Investors and VCs have skin in the game and wouldn’t want to lose their money. If you have a company that aligns with a supercharged business, you can expect more business from them based on the funding rounds.

A company must undergo several fundraising rounds before reaching the IPO stage to allow investors to put money in the company for some equity and partial ownership. An investment done at the ideation or concept stage is called seed funding. This funding could be for prototype development, product trials, proof of concept and initiate market entry.

What is Series A funding?

This initial round of funding generates anywhere from USD 2 million to USD 15 million. The money raised in this round translates into the trust investors have in an entrepreneur. Seed funding is for the great idea that a founder pitches to the investors, and Series A funding assures that the great idea can sell in the market and that the founder has the skills, expertise, and ethics to see it through.

What is Series B funding?

This round is initiated to fuel a business’s growth stage, generating around USD 15 million to 20 million. Once the entry to the market is initiated, the product or service has received a positive response and a user base has been created, a business is ready to take off and move on to the next stage. The money bridges the gap between supply and demand and prevents cash flow from being a hurdle in seamless expansion.

What is Series C funding?

Once a company has had a successful run in the market, it seeks money to develop new product lines, aggressively acquire new markets, or maybe acquire some other small businesses. This is where the Series C funding comes in. The capital gives businesses a much-needed boost to a company’s expansion plans.

Most businesses file for an IPO listing after the series C funding. However, there have been instances where companies go beyond when they feel they aren’t ready for it yet. Stripe announced the Series I round; similarly, ElevateBio went for a Series D funding round.

Understanding series and funding rounds gives start-up founders and business owners a perspective and edge in evaluating their ideas’ potential and marketability. This information also enables entrepreneurs to understand investors’ expectations and how equity stake works. They can understand how not all money is equal, and in the long run, this will impact their profit. Pitching to an investor also means a reality check. Entrepreneurs can course correct and change their strategy based on the investors’ suggestions. Female entrepreneurs can prepare themselves against systematic biases and leverage this awareness to address these pain points in their pitch. However, it all boils down to the fact that budding entrepreneurs, business owners, and founders meet the right investors.

Also read: How can worldwide funding data feed improve your overall investing strategy?

How does the funding database help businesses beyond funding?

On the other hand, company funding information helps businesses connect with recently funded companies. Apart from including information on funding rounds and funds generated, such datasets also cover comprehensive data on acquisitions, mergers, investors, valuation, and net sales, providing an overview of a company’s economic health. Businesses can screen companies and industries that are reaching the maturity phase and up for the next round of funding, helping them optimise their networking efforts.

A funding database can help businesses:

Targeted Marketing Efforts: Businesses can elevate their networking game with targeted marketing efforts and reach out to companies with the means, motive, and opportunity to collaborate with them and grow synergistically. A funded company in its growth phase might seek the tools, services, or solutions to aid its expansion plan. Using global funding data, your business can happen to be at the right time and at the right place!

Find your investment: Looking to give your entrepreneurial dreams the tailwinds of cash flow? Don’t worry! Company funding information consists of investors and company identifiers that can help a business connect with investors effectively. Sometimes, casting a wide net may not be as lucrative as it can dilute your efforts and be twice as time-consuming. Hence, it pays to double down on a targeted approach to finding the right investors for your business using a funding database.

Understand the market: A business’s success lies in understanding the market effectively. The global fundings data is much more than just investors’ data and a company’s funding information. It helps businesses derive actionable insights and use them to their advantage. Analysing it can help businesses decode market trends and gain a competitive advantage. For instance, if investors are making a beeline for a tech product or a company’s valuation has dropped, and it has raised lesser funding, it tells the bearish market sentiment for the segment. It shows where the priorities of such a business would lie. A funded business with investors’ blessings would seek to hire and expand aggressively, and it might be the right time for another tech business to make its mark. However, if it is a different scenario, a business may want to rethink its strategy and wouldn’t like collaborating with new businesses or hiring new people. Forget IPO. It may not even be profitable, which reflects the market’s response to their product or services. Should other businesses offer similar services, tools or solutions, they can take notice and rejig their marketing plans and sales efforts.

Network with fellow investors: Founders and angel investors can use the company funding information to connect with like-minded VCs and investors to explore collaboration opportunities, expand their investment scope and share insights while staying abreast of industry trends.

Discover funding avenues: Sometimes, it is challenging for start-ups and businesses to secure funding for their project despite their potential. Most SMEs stick to the traditional way of securing capital, including bank loans, research funding, grants, or crowdfunding. Using global fundings data, investors can identify potential funding avenues that align with their objectives and help businesses realise their growth story. Investors can find promising early-stage companies hungry for investments and get the most of their money and time using the funding datasets.

Strategic talent acquisition: Company funding information offers unmissable patterns about a business expansion plan and labour market. Along with the jobs feed data, businesses can use this information to dig deeper into the profiles of prospective hires. The data points such as name, job title, location and experience can provide much-needed key insights about the verticals a business is expanding into and its growth potential. Leveraging this information can also benefit businesses in optimising their HR strategies accordingly.

How can BizProspex help?

BizProspex offers reliable and accurate company funding information for investment research, lead generation and market analysis. This financial data, coupled with AI and predictive analytics, helps businesses connect with recently funded companies that are expanding and looking for the right partners. We utilise AI to scrape the funding data off the internet. The real-time company funding information is automated, easy to use and cost-effective. It helps businesses save time and money on training and allocating resources. Since the core teams can focus on productive tasks and don’t need technical expertise in data collection or extraction, businesses can save time and money. Businesses don’t have to manually scrape through to find relevant data and leverage extensive, well-rounded firmographic datasets to discover investment and networking opportunities.

We deliver parsed, structured and verified databases that the marketing and sales teams can use immediately. Businesses can choose a convenient delivery option that works well for them. Rest assured, data is secure, encrypted and remains confidential. Our dedicated support team ensures no opportunity is missed and maximum output can be achieved. Our company funding data has also proven to be a valuable resource for companies that want to reach out to like-minded investors and for businesses that want to collaborate with more recently funded companies in hopes of growing together. Our global fundings data cover companies, their funding information, budget allocation, valuation and profiles across the globe. The data is updated monthly and can be customised to align with your business’s specific requirements.

This isn’t it! 100+ high-quality data points can help you close your next growth partner! So, what are you waiting for? Learn more about how BizProspex global fundings data can help your business reach the right leads. Contact us here.