Global Sanctions lists: what are they?

A global sanctions list is a systematic database or list maintained by governments, international organisations, or regulatory bodies, which identifies individuals, organizations, or countries to be sanctioned economically or legally. Generally, these sanctions are imposed to protect human rights, national security, or foreign policy. Those on the lists are restricted from participating in certain activities, such as trade, financial transactions, or travel, because they have been involved in illegal or harmful activities, like terrorism, human rights abuses, or nuclear proliferation.

Global sanctions lists are formal records of individuals, organizations, and occasionally entire nations that face economic or trade restrictions imposed by governments or international groups. These measures are typically intended to influence behaviors in political, economic, or military spheres, or to combat illegal activities such as terrorism, nuclear proliferation, or violations of human rights. Those identified on these lists encounter various restrictions, which can include asset freezes, travel bans, and limitations on conducting business with companies and individuals in sanctioned regions.

Here are a few key global sanctions lists:

- United Nations Security Council Sanctions List (UNSC): The UNSC imposes sanctions to maintain international peace and security, targeting entities involved in terrorism, arms trafficking, or violating international law.

- Office of Foreign Assets Control (OFAC) Sanctions List (U.S.): Maintained by the U.S. Department of the Treasury, this list includes Specially Designated Nationals (SDNs) who are blocked from accessing the U.S. financial system or conducting transactions with U.S. entities.

- European Union Sanctions List: The EU imposes sanctions to support its foreign and security policies, often in coordination with the United Nations or the U.S. These measures can include travel bans, asset freezes, and restrictions on trade.

- UK Sanctions List: The UK government maintains its own list post-Brexit, targeting individuals and entities that pose threats to national or international security.

- Canada’s Sanctions List: Maintained by Global Affairs Canada, it includes individuals and entities sanctioned for terrorism, human rights abuses, or serious international law violations.

- Other National Lists: Many countries maintain their own sanctions lists, such as Australia, Japan, and Switzerland, often coordinated with larger bodies like the UN.

If you are on one of these global sanctions lists, it can significantly hinder an individual or organization’s ability to participate in global trade and access financial services. While the extent and enforcement of these sanctions can differ across regions, their primary aim is to exert pressure to alter behaviours that are considered harmful or unlawful.

Global Sanctions lists are the instruments for foreign policies

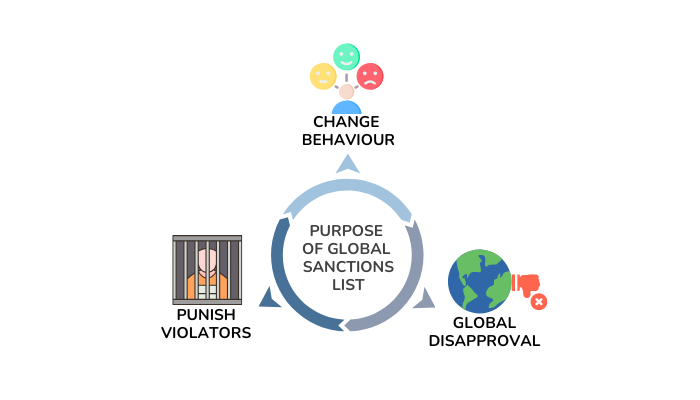

As a foreign policy tool, sanctions lists provide governments with the ability to exert pressure without involving military action or direct conflict. The purpose of sanctions is to restrict economic, trade, or diplomatic relations between countries, entities, or individuals in order to:

- Change behaviour: Global sanctions lists are tools used by international bodies, such as the United Nations, and individual countries or groups of countries, like the United States or the European Union, to influence the behavior of nations, groups, organizations, and individuals. They serve multiple purposes, primarily aimed at encouraging political reform, enforcing compliance with international law, and deterring aggressive behaviours.

- Punish violators: Global sanctions are enforced through a range of punitive measures aimed at individuals, organizations, or governments that violate them. These punishments can vary based on the severity of the violation, the jurisdiction imposing the sanctions, and the entity involved. They are used to punish human rights abuses, terrorist sponsors, and illegal arms traffickers.

- Global disapproval: Sanctions signal global disapproval of certain actions and prevent them from coming to pass. Global sanctions serve as a powerful tool for signalling global disapproval of certain actions, behaviours, or policies by governments, organizations, or individuals. This disapproval is expressed through economic, diplomatic, and political measures that isolate and pressure the targeted entities.

It is possible to achieve these goals without incurring catastrophic costs or causing instability at the geopolitical level.

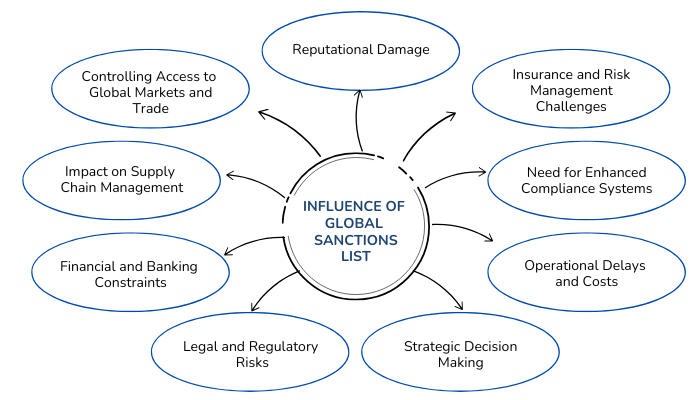

How do Global Sanctions Lists impact businesses worldwide?

Global sanctions lists have tremendous and far-fetched impacts on businesses worldwide, influencing various aspects of trade, finance, compliance, and operations. Global sanctions lists influence international trade in ways such as:

- Controlling Access to Global Markets and Trade

- Prohibition on Transactions: Businesses are strictly forbidden from engaging in financial transactions, trade, or any form of business dealings with individuals, companies, or nations identified on global sanctions lists. This encompasses a wide range of activities, including the sale of products and the procurement of raw materials. Compliance with these regulations is crucial to maintain integrity and uphold legal standards.

- Export/Import Controls: Global Sanctions typically impose restrictions on the export of goods, technology, or services to designated entities or countries. For instance, businesses might be prohibited from exporting dual-use items—those that can serve both civilian and military purposes—to nations such as North Korea or Iran.

- Impact on Supply Chain Management

- Indirect Relations: Businesses can still be exposed to sanctions through indirect relationships with suppliers, customers, and partners even if they aren’t directly associated with sanctioned entities. A company could inadvertently become involved in a supply chain that involves a sanctioned entity, resulting in legal and financial complications.

- Compliance Burden: Companies should consistently assess their partners, customers, and suppliers to confirm they aren’t engaging with sanctioned individuals or entities. This task can be quite intricate and demands significant resources, particularly for businesses operating with international supply chains.

- Financial and Banking Constraints

- Restricted Access to Financial Systems: Banks and financial institutions are particularly sensitive to sanctions. Businesses that have ties to entities on sanctions lists may find themselves cut off from global financial systems, including being denied access to payment networks, loans, or international banking services.

- Asset Freezes: Assets of individuals or companies on sanctions lists can be frozen. If a business has financial relationships or holdings tied to these entities, their funds could be seized or rendered inaccessible.

- Legal and Regulatory Risks

- Heavy Fines and Penalties: Failing to comply with sanctions can result in hefty fines, legal actions, or criminal prosecution. For example, violating U.S. sanctions imposed by OFAC can lead to multi-million-dollar penalties or even the suspension of business operations.

- Cross-Border Legal Complexities: Sanctions are often enforced at the national level, meaning businesses must navigate multiple, sometimes conflicting, sanctions regimes. For example, U.S. companies might face restrictions that do not apply in the EU or vice versa, creating legal complexities for multinational firms.

- Reputational Damage

- Brand and Investor Impact: Being associated with or doing business with sanctioned entities can cause significant reputational harm. This can lead to a loss of customer trust, a drop in stock prices, or withdrawal of investments by risk-averse investors.

- Corporate Social Responsibility Concerns: Investors and consumers expect companies to maintain high ethical standards as part of their corporate social responsibility (CSR). An organization’s brand image can be harmed by indirect dealings with sanctioned parties involved in human rights abuses, terrorism, or corruption.

- Insurance and Risk Management Challenges

- Limited Insurance Coverage: Businesses involved with sanctioned entities might face difficulties in securing insurance coverage, as many insurers are unwilling to underwrite risks associated with sanctions violations.

- Higher Risk Profiles: Companies that operate in high-risk regions or industries subject to sanctions, like energy, defence, or technology, may see increased insurance premiums, difficulty securing financing, and more stringent compliance requirements.

- Need for Enhanced Compliance Systems

- KYC (Know Your Customer) and Due Diligence: Businesses must implement robust compliance programs, including thorough Know Your Customer (KYC) processes to verify that their clients and partners are not on sanctions lists. This can be a significant administrative and operational burden.

- Regular Monitoring: Sanctions lists are frequently updated, so businesses must continuously monitor and ensure ongoing compliance. Automated compliance tools and services are often required to keep up with evolving regulations.

- Operational Delays and Costs

- Contractual Delays: Sanctions can cause delays in contract execution, as businesses may need to obtain special licenses or clearances from government authorities before proceeding with deals.

- Increased Costs: Compliance programs, legal counsel, and the potential need to restructure business deals or supply chains can significantly increase operational costs for businesses navigating global sanctions.

- Strategic Decision Making

- Market Exits and Reconfiguration: Businesses may need to exit certain markets or reconfigure their operations to avoid sanctioned entities. This can lead to strategic shifts, such as divesting from certain regions or sectors or seeking alternative markets and suppliers.

- Cross-border Tensions: Sanctions can create political tensions that businesses must navigate, especially if they are operating in regions where different countries have conflicting sanctions regimes. For example, some companies may need to choose between complying with U.S. sanctions or EU sanctions.

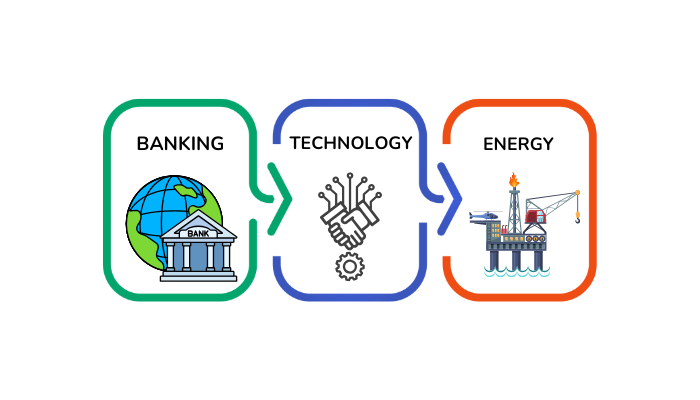

Examples of Impact:

- Banking: Global banks like HSBC, BNP Paribas, and Standard Chartered have paid billions of dollars in fines for violating U.S. sanctions.

- Technology: Tech companies like Huawei have been targeted by sanctions due to concerns over national security and have been barred from accessing certain technologies, markets, and financial systems.

- Energy: Oil companies, such as TotalEnergies and BP, have been affected by sanctions related to Russia, Iran, and Venezuela, forcing them to reconsider or exit major energy projects.

Summary

As a result, global sanctions lists severely restrict businesses’ ability to trade, complicate compliance, and expose them to legal and reputational risks. Adapting to international regulations and maintaining rigorous compliance systems are keys to navigating these challenges.